Cataract surgery is one of the most common and essential medical procedures for those with significant vision loss due to cataracts. Many people are curious about whether insurance will cover the cost of this crucial eye surgery. This article will provide you with all the information you need, Is Cataract Surgery Covered by Insurance, from understanding what cataract surgery involves to navigating the insurance claims process, out-of-pocket costs, and what to do if your policy doesn’t fully cover the procedure?

Is Cataract Surgery Covered by Insurance?

Cataract surgery is often covered by insurance, particularly by Medicare and private health insurance plans, as it is considered a medically necessary procedure. However, coverage may vary depending on the specific insurance plan, the type of lenses used, and whether the surgery is deemed medically necessary or elective. It’s important to check with your insurance provider to understand the details of your coverage.

Understanding Cataract Surgery

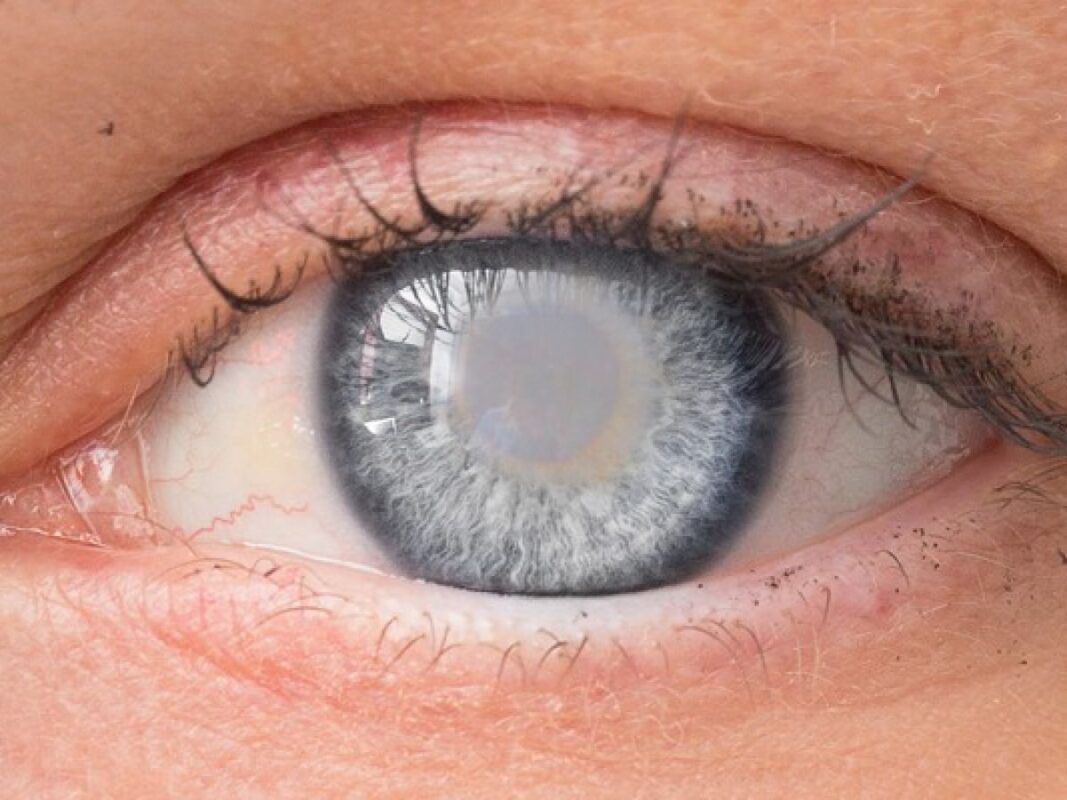

What is Cataract Surgery?

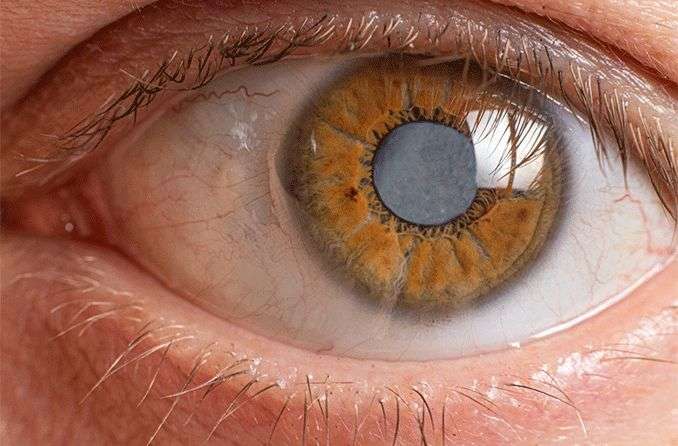

Cataract surgery is a procedure that removes the cloudy lens from the eye and replaces it with an artificial intraocular lens (IOL). Cataracts often develop naturally with age, leading to blurred or dimmed vision. The surgery is typically safe, quick, and minimally invasive, improving vision significantly for the majority of patients.

Why is Cataract Surgery Necessary?

As cataracts progress, they can impact everyday activities like reading, driving, and recognizing faces. In severe cases, they can lead to blindness if untreated. Cataract surgery restores clarity and vision, allowing individuals to regain independence and quality of life.

Who Should Consider Cataract Surgery?

Doctors recommend cataract surgery for people whose vision impairment interferes with their daily life. Eye doctors will evaluate the severity and progression of cataracts before suggesting surgery as an option.

Health Insurance Basics for Medical Procedures

What is Health Insurance Coverage?

Health insurance coverage refers to the protection provided by your insurance policy for various medical treatments. Different policies cover different services and expenses, including doctor’s visits, medications, and specific procedures, depending on the plan’s details.

Types of Insurance Plans and Their Coverage Levels

There are several types of health insurance plans, including employer-provided insurance, private insurance, and government plans like Medicare. Each type of insurance has different levels of coverage, which affect what portion of medical costs the insurer will pay and what the insured person must cover out of pocket.

Is Cataract Surgery Covered by Insurance

Many insurance plans, including Medicare, typically cover cataract surgery, as it’s classified as a medically necessary procedure. However, coverage details vary widely among different insurance providers and plans.

Medicare vs. Private Insurance

Medicare and private health insurance often cover the standard cataract surgery with basic lens replacement. However, advanced options, such as laser-assisted surgery or premium lenses, may incur additional costs. Private insurance policies also have varying limits, so it’s essential to review your policy for specific details.

Insurance typically includes coverage for essential aspects of the procedure.

Standard insurance coverage generally includes the surgical removal of the cataract and insertion of a basic monofocal lens. It may also cover pre-surgical and post-surgical care to a certain extent. Any extra features, such as premium IOLs or laser surgery, may require out-of-pocket payments.

Medicare Coverage for Cataract Surgery

Eligibility for Medicare Cataract Coverage

Most people aged 65 or older qualify for Medicare, which typically covers necessary cataract surgery. Those under 65 with specific disabilities or illnesses may also be eligible.

Parts of Medicare Covering Cataract Surgery (Part B, Part C)

Medicare Part B covers outpatient services and medically necessary procedures, including cataract surgery. Alternatively, Medicare Advantage plans (Part C) also cover cataract surgery but may have additional benefits, limitations, or requirements depending on the provider.

Private Health Insurance Coverage

Policy Variations and What They Mean

Private health insurance policies vary greatly, so it’s essential to understand the specifics of your plan. Some policies cover only the basics, while others may offer broader coverage that includes advanced procedures or lens types.

Out-of-Pocket Expenses for Cataract Surgery

Depending on the type of insurance, out-of-pocket costs can include deductibles, copays, and any additional fees for premium services or lenses. Patients should review their policy closely and request a detailed cost estimate from their insurance provider.

What Costs Are Not Covered?

Common Exclusions in Insurance Plans

Most insurance policies do not cover premium lenses or laser-assisted cataract surgery, considering these options as non-essential upgrades. Additionally, some policies might not include follow-up care or prescription medications related to surgery recovery.

Cost of Premium Lenses and Laser-Assisted Surgery

While standard cataract surgery is generally covered, advanced options like multifocal or toric lenses for astigmatism correction are often excluded. Laser-assisted surgery, which provides more precision, may also be considered an elective upgrade.

Co-Payments and Deductibles for Cataract Surgery:

What Are Co-Payments?

Co-payments are fixed amounts paid by the patient for services covered by insurance. For cataract surgery, this may apply to doctor visits or other related services, depending on the insurance plan.

How Deductibles Work for Cataract Surgery

A deductible is the amount a patient must pay out of pocket before the insurance begins covering costs. Once the deductible is met, the insurance typically covers a higher percentage of the expenses.

Coverage Limits to Consider

Some insurance plans have a maximum limit on coverage for specific procedures. Understanding these limits is essential to avoid unexpected costs.

Financing Options if Insurance Doesn’t Fully Cover Cataract Surgery

Financing Programs Through Hospitals and Clinics

Many clinics offer financing options to help patients manage out-of-pocket expenses, providing payment plans that break down the total cost into manageable monthly payments.

Payment Plans and Health Loans

Some patients choose to use health-specific loans or financing programs for elective expenses related to cataract surgery. Flexible options are available, and some have low-interest rates for eligible patients.

What Affects the Cost of Cataract Surgery?

Type of Lenses:

Premium lenses are more expensive and may provide benefits like astigmatism correction or multifocal vision. These lenses are typically not covered by insurance and increase the overall cost of surgery.

Laser-Assisted vs. Traditional Surgery

Laser-assisted surgery, while more precise, is considered an upgrade and may not be covered by most insurance policies. Traditional surgery, however, is often covered.

Location and Surgeon Expertise

Surgery costs may vary depending on the surgeon’s experience, location, and facility fees. Highly experienced surgeons or surgeries performed in private clinics may be more expensive.

How to Check Your Insurance Coverage:

Steps to Confirm Coverage for Cataract Surgery

Start by contacting your insurance provider to discuss your coverage options for cataract surgery. It’s helpful to provide details about the procedure, such as the type of lenses and the surgeon’s location, to get a clear understanding of potential costs.

How to Read an Insurance Policy for Cataract Surgery Benefits

Insurance policies can be complex, so take time to read the sections on coverage for surgical procedures, deductibles, and out-of-pocket maximums.

Filing Claims for Cataract Surgery:

Steps to File a Successful Claim

Ensure you have all the necessary documentation, such as doctor’s notes and detailed invoices. Submit your claim promptly to avoid delays, and follow up with your insurer if you haven’t received a response within their specified time frame.

How to Handle Denied Claims

If your claim is denied, you have the right to appeal. Contact your insurer to understand the reason for denial and gather additional documentation if needed.

Tips for Faster Processing

Accurate information and prompt submission help expedite the claim process. Double-check all forms and keep a copy for your records.

Preparing Financially for Cataract Surgery:

Saving for Unexpected Costs

Having a financial plan is essential, as there may be additional costs not covered by insurance. Consider setting aside funds or using a Health Savings Account (HSA) if eligible.

Setting Up a Health Savings Account (HSA)

An HSA offers tax advantages for medical expenses, allowing individuals with high-deductible health plans to save for out-of-pocket healthcare costs, including those for cataract surgery.

Alternatives if Insurance Does Not Cover Cataract Surgery:

Non-Surgical Options for Early-Stage Cataracts

For early-stage cataracts, lifestyle adjustments and stronger prescription glasses may temporarily improve vision.

Programs Offering Subsidized Care

Some nonprofits and government programs offer financial assistance for cataract surgery for those who qualify based on income or other criteria.

Author Details:

Dr. Sushruth Appajigowda holds a prominent position as a Cornea, Cataract, Glaucoma, and LASIK Surgeon in Bangalore. He serves as the chief Cataract and Refractive surgeon at Vijaya Nethralaya Eye Hospital, Nagarbhavi Bangalore. Renowned as one of the finest LASIK surgeons nationwide, he brings with him over 12+ years of experience across multiple LASIK platforms, including ZEISS, ALCON, SCHWIND, AMO, and Bausch and Lomb. Having successfully conducted over 5000 LASIK procedures, Dr. Sushruth holds the title of a Certified Refractive Surgeon and a Fellow of the All India Collegium Of Ophthalmology. Furthermore, he stands as a distinguished speaker at various National and International Forums, using his expertise to guide you in selecting the most suitable procedure based on your health requirements.

http://vijayanethralaya.com/link-in-bio/

Frequently Asked Questions (FAQs):

- What are the most common cataract surgery costs? Costs typically include the surgeon’s fee, anesthesia, facility fees, and follow-up visits.

- Is cataract surgery considered elective or essential? Cataract surgery is generally considered essential if it significantly impacts vision.

- Does Medicare cover all lens types? No, Medicare usually covers only standard monofocal lenses.

- Can I choose my cataract surgeon? Yes, though some plans may have restrictions on out-of-network providers.

- Is a second surgery covered if complications occur? Most insurers cover follow-up procedures if medically necessary.

- Will my insurance cover pre- and post-surgery care? Many policies cover essential pre-op and post-op care, though some costs may still be out-of-pocket.

Conclusion:

Most insurance plans, including Medicare, cover essential cataract surgery costs, but options like premium lenses and laser-assisted surgery may require out-of-pocket payment. Reviewing your insurance policy closely and understanding terms like deductibles and co-pays is crucial to avoid unexpected expenses. If your coverage is limited, consider financing options or health savings accounts to manage costs effectively. Being informed helps you make the best financial and health decisions for a clear, improved vision.